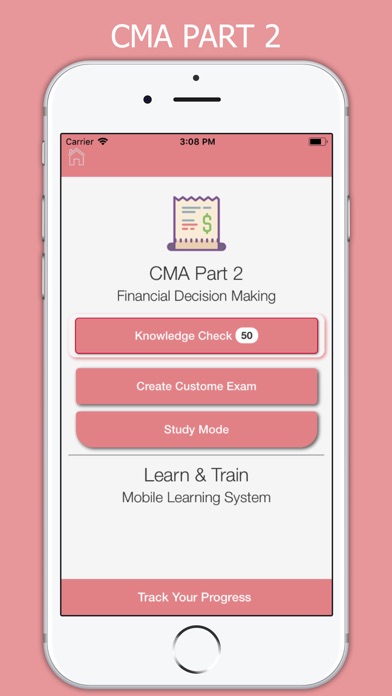

CMA Part 2: Financial Decision Making

The percentages show the relative weight range given to each section in the exam.

A. Financial Statement Analysis – 25%

Principal financial statements and their purposes; limitations of financial statement information; interpretation and analysis of financial statements including ratio analysis and comparative analysis; market value vs. book value; fair value accounting; international issues; major differences between IFRS and U.S. GAAP; off-balance sheet financing; Cash Flow Statement preparation, analysis, and reconciliation; and earnings quality.

Topics Tested:

– Basic Financial Statement Analysis

– Financial Ratios & Performance Metrics

– Profitability Analysis

– Special Issues

B. Corporate Finance – 20%

Types of risk; measures of risk; portfolio management; options and futures; capital instruments for long-term financing; dividend policy; factors influencing the optimum capital structure; cost of capital; raising capital; managing and financing working capital; mergers and acquisitions; and international finance.

Topics Tested:

– Risk & Return

– Long Term Financial Management

– Raising Capital

– Working Capital Management

– Corporate Restructuring

– International Finance

C. Decision Analysis – 20%

Relevant data concepts; cost-volume-profit analysis; marginal analysis; make vs. buy decisions; income tax implications for operational decision analysis; pricing methodologies including market comparables, cost-based and value-based approaches.

Topics Tested:

– Cost/Volume/Profit Analysis (CVP Analysis)

– Marginal Analysis

– Pricing

D. Risk Management – 10%

Types of risk including business, hazard, financial, operational, strategic, legal compliance and political risk; risk mitigation; risk management; risk analysis; and ERM.

Topics Tested:

– Enterprise Risk

E. Investment Decision – 15%

Cash flow estimates; discounted cash flow concepts; net present value; internal rate of return; non-discounting analysis techniques; income tax implications for investment decisions; ranking investment projects; risk analysis; real options; and valuation models.

Topics Tested:

– Capital Budgeting Process

– Discounted Cash Flow Analysis

– Payback & Discounted Payback

– Risk Analysis in Capital Investment

F. Professional Ethics – 10%

Ethical considerations for the organization

Topic Tested:

– Ethical considerations for management accounting and financial management professionals.

– Ethical considerations for the organization.

App Features:

• 2018 Latest Update

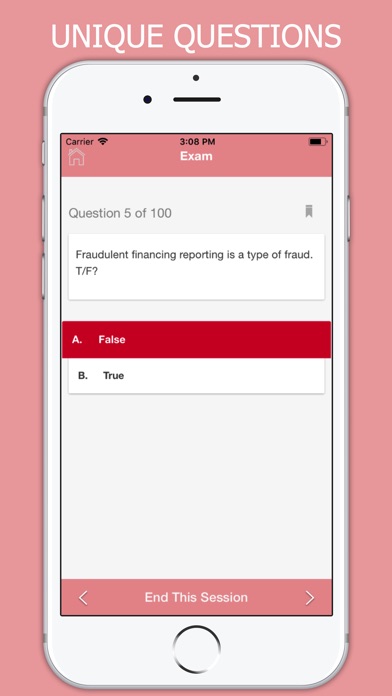

• Two Exam Modes: Virtual Mode, and Study Mode

• Quick Knowledge Mode

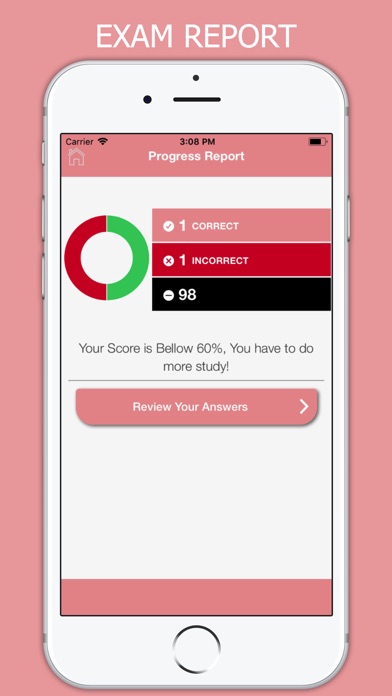

• Review Your Answers

• Well Researched Questions

• Auto Save Exam

• Progress Log

• Smart Filters

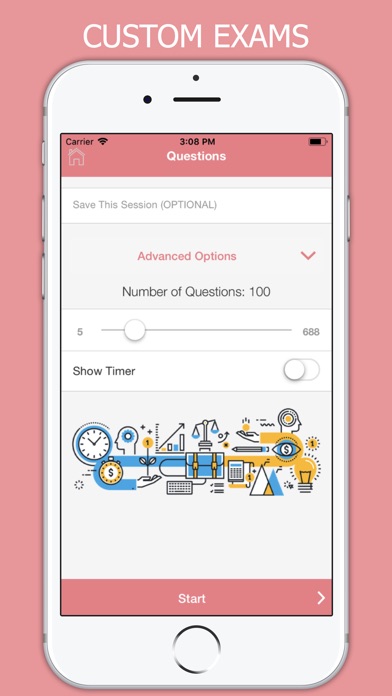

• Create Custom Exams

• Bookmark Questions

• Based on 2018 Syllabus

• Unique Questions

• No Additional Purchases or Subscriptions

• No Internet Connection is required

• Free Feature Updates

• Highest Passing Rate!

DISCLAIMER:

---

Learn & Train is Not Affiliated With Respected Testing Agency, Test/Exam Name or Any Trademark.